- #NEW YORKBASED SMARTASSET 110M TTV CAPITAL DRIVER#

- #NEW YORKBASED SMARTASSET 110M TTV CAPITAL PROFESSIONAL#

- #NEW YORKBASED SMARTASSET 110M TTV CAPITAL SERIES#

TTV Capital led SmartAsset’s Series D, which also included participation from Javelin Venture Partners, Contour Venture Partners, Citi Ventures, New. The financing values New York-based SmartAsset at over 1 billion. The firm's track record includes Green Dot, Cardlytics,, Greenlight, MX, Smartasset, Shopkeep, Paycycle, Scratchpay, and Featurespace. SmartAsset, a marketplace that connects consumers to financial advisors has raised 110 million in a Series D round of funding. TTV is one of the preeminent investors in fintech. Welcome Tech, which wants to build a ‘super app’ for immigrants, raises 30M Mary Ann Azevedo.

"We will invest $1 - $5 million in support of early-stage fintech companies led by dedicated founders with a strong, clear mission." "We founded TTV in 2000 because we believe that there is a compelling need for innovation and technology advancement throughout the financial industry," said Gardiner Garrard, co-founder and managing partner, TTV. To date, TTV Fund V has invested in a number of companies including: Koho, Neuro-ID, Plink, Samcart and Taxbit. TTV Fund V includes both existing and new limited partners, including endowments, foundations, family offices and strategic partners. The Fund will continue to back founders that are creating innovative applications that build upon enabling technologies like cloud computing, big data, mobile, machine learning, AI, and blockchain, to disrupt and modernize the banking and payments sector. TTV Capital announced today that the firm has closed its oversubscribed fifth fund, raising 127 million. TTV Capital TTV Capital is an early-stage venture capital firm that invests in fintech companies offering financial products and services. TTV Fund V includes both existing and new limited partners, including endowments, foundations, family offices and strategic partners. SmartAsset raised 110000000 on in Series D. The company, founded in 2012, now handles over 100M customer interactions per month, is responsible for originating $1.5B in new assets under management for advisors per month, and is nearing $100M in ARR.TTV Capital announced today that the firm has closed its oversubscribed fifth fund, raising $127 million.

Exciting day for SmartAsset Raising 110m of Series D equity capital & achieving Unicorn status TTV Capital leading + Moelis & Company.

#NEW YORKBASED SMARTASSET 110M TTV CAPITAL DRIVER#

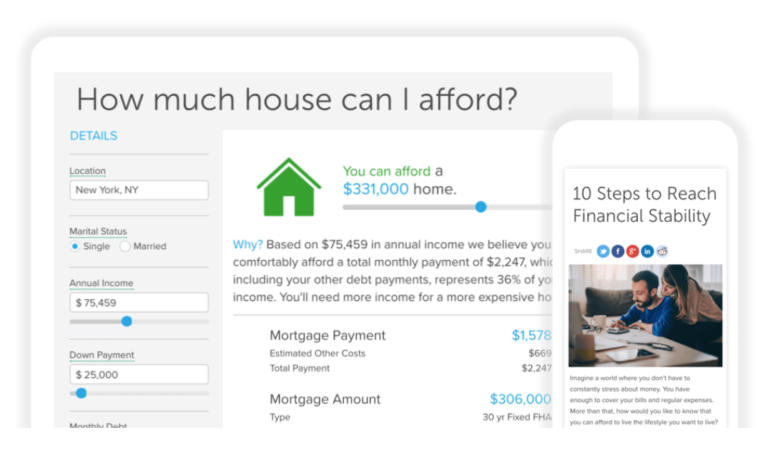

By using content as a driver of interest, SmartAsset can connect interested individuals with advisors that will meet their investment goals, preferences, and criterion. Check out our new look and all of our services. SmartAsset is a personal finance content engine that distributes content, tools, and calculators related to common, everyday financial issues as well as a customer acquisition platform for the personal finance advisory industry. In either case, it's likely these people interacted with this NYC startup without even knowing it.

#NEW YORKBASED SMARTASSET 110M TTV CAPITAL PROFESSIONAL#

Many also established relationships with professional financial advisors. New York-based SmartAsset, a marketplace that connects consumers to financial advisors, raises 110M Series D led by TTV Capital at over 1B valuation. With the internet, many of these individuals chose to go the self-directed route. NEW YORK - JSmartAsset, the Internets most-viewed financial technology company helping people make smarter financial decisions, has raised 28 million in. Source: AlleyWatch SmartAsset: SmartAsset Raises $110M to Modernize Personal Finance and Drive Leads for Financial Advisors The importance of managing personal finances came to the forefront during the pandemic as individuals sought to buffer themselves against the effects of COVID and the economy. SmartAsset, a marketplace that connects consumers to financial advisors, announced today that it has raised 110 million in a Series D round of funding.

0 kommentar(er)

0 kommentar(er)