Best Card for Building Business Credit: Secured MasterCard® from Capital One Learn more about this card on the Brex website.

Divvy credit card full#

More rewards when you pay your bill in full weekly.

Divvy credit card software#

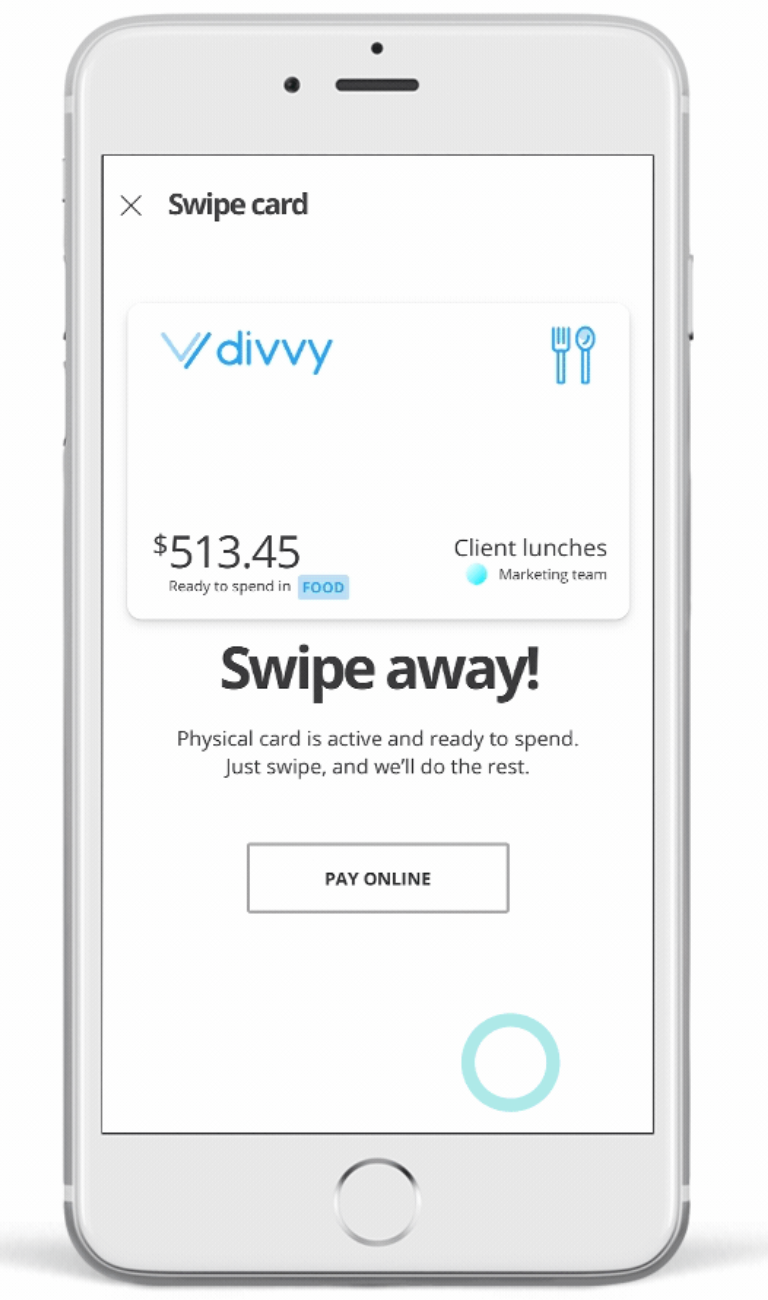

Track expenses in Xero, QuickBooks, and other accounting software.Divvy up your credit limit across your corporate cards.Free expense management and accounting software.When you choose Divvy, you’ll earn rewards for all your spending and get helpful expense management and accounting softwares. You’ll also be able to track expenses, assign unlimited cards to your employees, set limits on those cards, and enjoy a sizable credit limit to help your business grow. With this card, you will never pay an annual fee, enjoy one of the highest rewards programs, and get guaranteed approval when you apply. Ideal for: New businesses that need a business credit card without having to rely on the business owner’s personal credit score for approval. And a regular credit builder for businesses having established tradelines. While no single card can fulfill the needs of every company, Divvy approves every business that applies and offers a simple way for any business to earn cash on their day-to-day expenses.ĭivvy offers two types of credit cards: A credit builder card for new businesses. The best overall business credit card is one that has easy credit approval, terms, sizable credit limits, a solid rewards program, no annual fee, and goes out of its way to help businesses establish and build a business credit. American Express Blue Business Plus is the best card to help finance your business because it charges no annual fee and allows maximum flexibility in redeeming rewards.Chase Ink Business Cash is the best card for purchasing office supplies because there is no annual fee, and you’ll get solid cash back at office supply stores and more.Secured MasterCard® from Capital One is the best card for building business credit because it carries all the power of regular MasterCard credit cards with no annual fee.Brex is the best card for higher credit limits.Divvy is the best overall card for small businesses.By the time you finish reading this review, you’ll know which business credit card is best for you. We’ll explore rewards, perks, benefits, rates, annual fees, and more. In this business credit card review, we’ll look at some of the top small business credit cards and share what makes them the right choice. Rewards and benefits you may want for your business.Choosing the best business credit card comes down to three things:

0 kommentar(er)

0 kommentar(er)